What Percent of Credit Utilization Is Best

Aim for a total utilization ratio and ratios for each credit card of no more than 30. This is the ideal utilization.

Credit Utilization How It Works And How To Improve It Lexington Law

Personally I keep mine under 5 at all times but I can easily do this.

. Using this amount of your credit will help your score improve fastest assuming. However maintaining 1 utilization on your credit report likely isnt a realistic goal. Your total available credit is 20000 and your total outstanding balance is 7000.

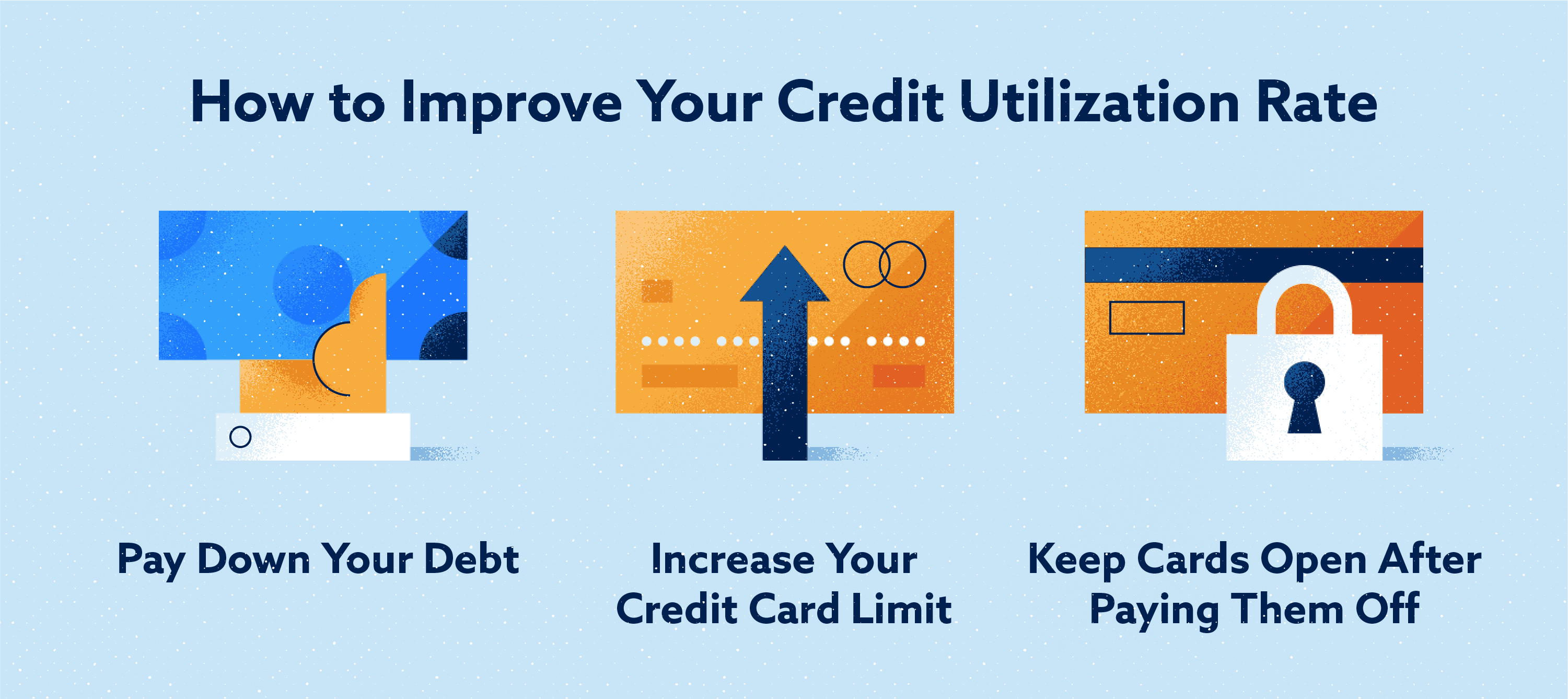

As such cardholders who have higher credit limits avoid overspending and pay off bills more frequently can have an easier time keeping their credit utilization in check. The best credit utilization is 0 percent which would mean youre not using any of your available credit. Many credit experts say you should keep your credit utilization ratio the percentage of your total credit that you use below 30 to maintain a good or excellent credit score.

Creditors like to see that you can handle making charges and. Keeping it under 30 or even better under 20 is typically a good strategy. Its also helpful to keep your credit utilization rate to less than 30 percent.

Anything under 20 is fine though. Your balance and credit limit information update on your credit report often enough that your credit utilization can be improved within 30 to 45 days. Whats the Best Credit Utilization Ratio.

Here are the best credit utilization ratios. Charging too much on your cards especially if you max them out is. Utilization is also rounded up to the next whole number.

What is a good credit utilization ratio. A good credit utilization ratio is less than 30 percent. For one FICOs scoring formula assigns credit score points to certain ranges of percentages.

9 In other words completely paying off your cards and not using them may not give you the boost you want. Its commonly said that you should aim to use less than 30 of your available credit and thats a good rule to follow. The general rule of thumb has been that you.

If one card has a balance of 5000 and the other has a balance of 2000 then your per-card utilization rate would be 50. But theres really no hard-and-fast rule. What is the ideal credit utilization ratio.

In general the lower your credit utilization the better but anything below 30 is considered good. To maintain a healthy credit score its important to keep your credit utilization rate CUR low. Whats an Excellent Credit Utilization Ratio.

While there are no hard-and-fast rules around what an ideal utilization ratio should be below 30 percent is typically recommended. While 30 is better than 60 for instance the goal should be to maintain as low credit utilization rate as possible. 1-20 is an A.

Having a 500 balance on a card with a 5000 credit limit would give you a 10 percent credit utilization rate. Your credit score will. The month before applying to a new loan the best utilization is around 1-9.

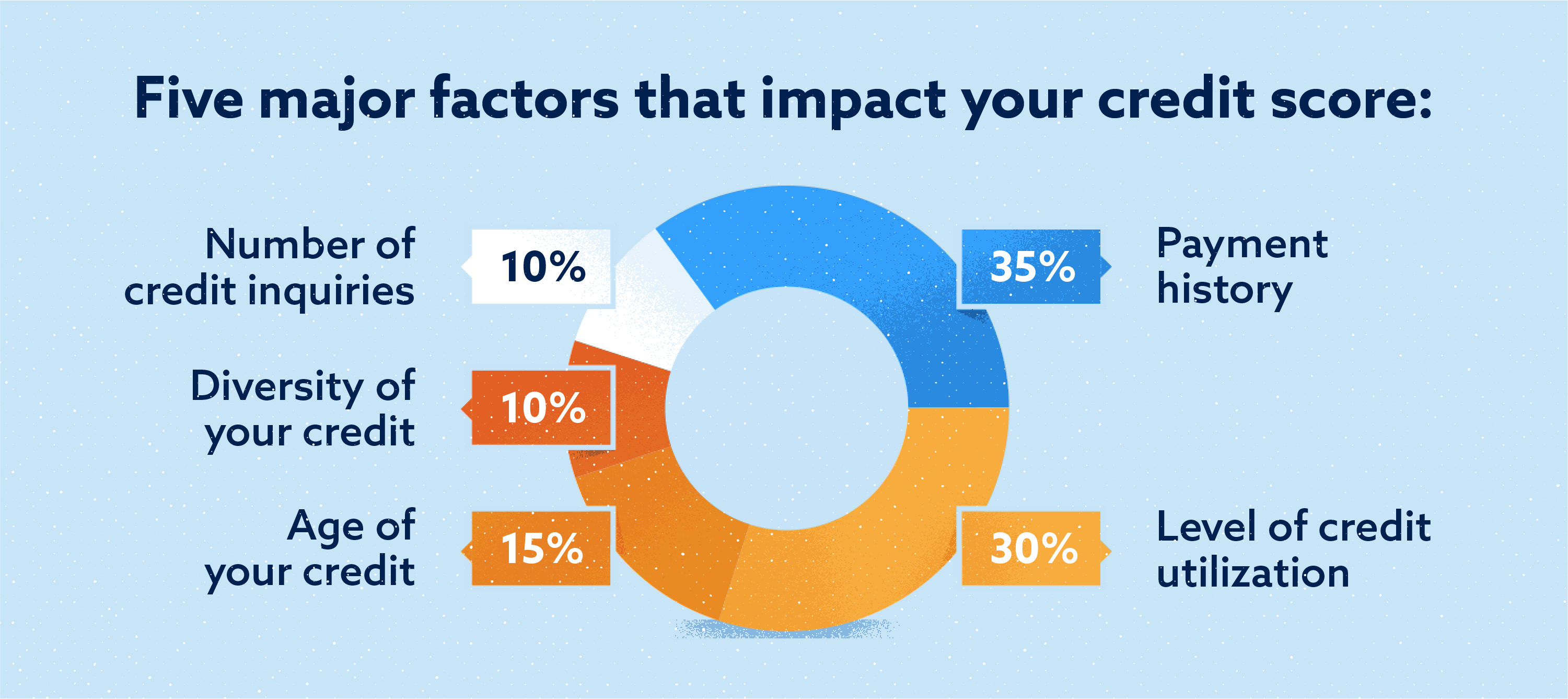

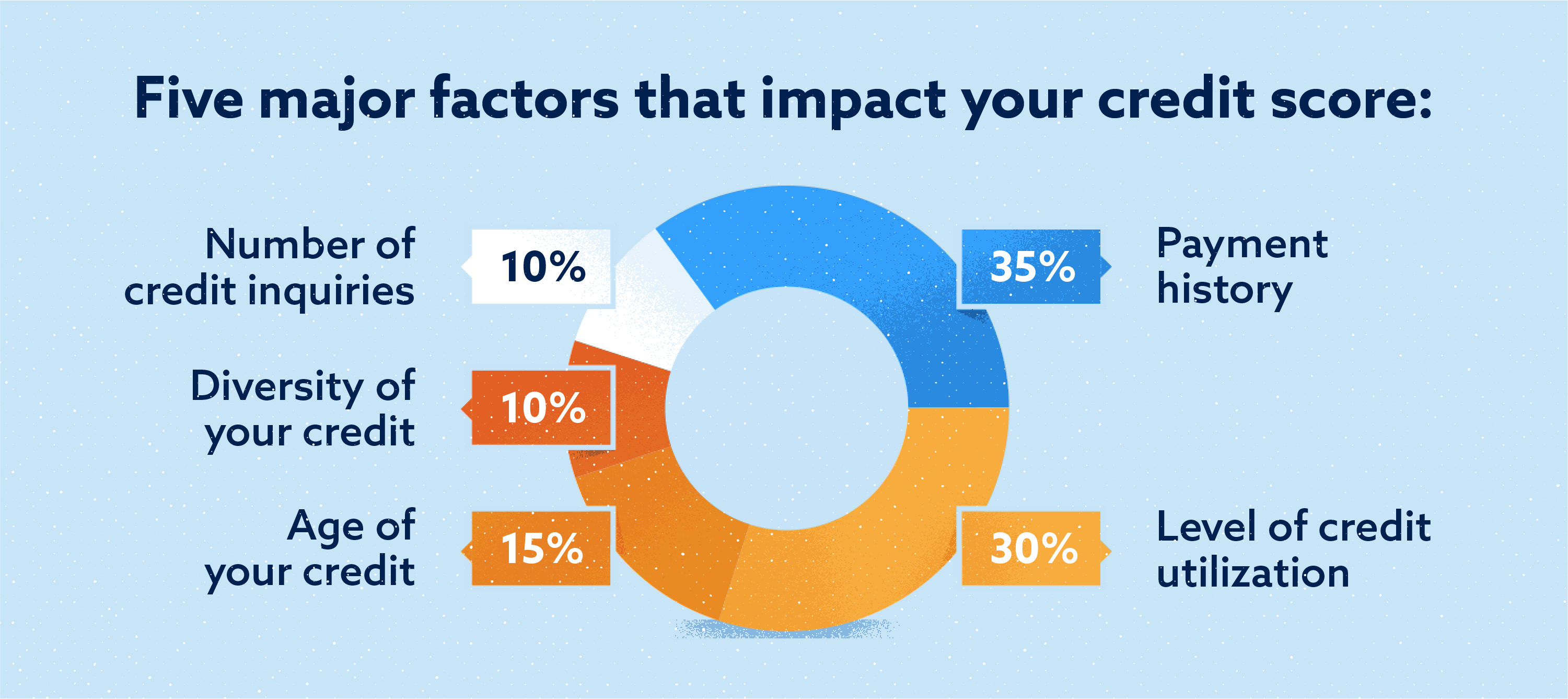

Credit utilization makes up roughly 30 of your credit score which makes it one of the most important factors in your credit report. Find a Card With Features You Want. Ad Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score.

If you need to use more than 30 of the limit consider spreading it across another card rather than maxing out one card but only if this makes financial sense. 8 A utilization of 1 is better than 0 however. Its generally recommended to keep your credit utilization below 30 and the lower the better.

So for example if your credit limit is 1000 on a card you might not want to use more than 300. In general youll earn more credit score points in most popular credit scoring models if youre using 1 of your overall available credit than if you have 0 overall utilization. As a result the best revolving credit utilization ratio may be 1.

Your overall credit utilization ratio would be 7000 20000 35. In it the CFPB reports the median cardholder utilization by credit score tier. NerdWallet suggests using no more than 30 of your limits and less is better.

Theres definitely no hard-and-fast rule when it comes to determining the percentage to use to maintain a good or even excellent credit score explains Anna Barker personal finance expert and founder of LogicalDollar. But to put a hard-and-fast rule on where every borrowers credit utilization ratio needs to be just wouldnt make sense. Lets say you have two credit cards each with a 10000 limit.

Surprisingly 0 isnt the best possible utilization. A good rule of thumb is to keep your credit utilization under 30. Best credit cards of 2022.

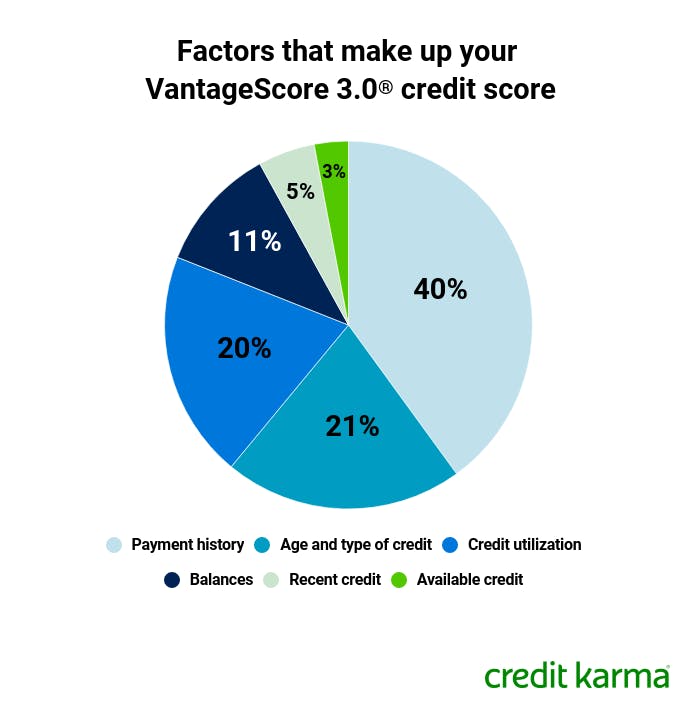

If your overall credit limit is 30000 across all of your cards your total balances should be under 9000 in a. A 1 credit utilization might be the best percentage to aim for since its a cross between showing activity on your account and keeping your utilization rate as low as possible. Consumers with prime credit scores of 660 to 719 which is generally considered good credit have a median credit.

A lower credit utilization ratio is better for your credit scores but a little utilization is better than none at all. 6 Continue this thread level 1 Aqua-Tech 7y According to CreditKarma 0 is a grade of C. Yes we can generally say that the best ratio to have as your credit utilization is below 20 but not higher than 30.

A common rule of thumb is to keep your credit utilization ratio below 30 but the lower your utilization the better. In general the lower your credit utilization ratio the better your credit score. However this rule is not set in stone.

Compare Your Capital One Card Options Today. If youre not getting the full number of points available for credit utilization some may consider that hurting. Your credit utilization ratio also called a utilization rate is a number that shows the percentage of available credit youre using on your revolving credit accounts such as credit cards.

Many experts have opined that the ideal credit usage ratio is under 30.

What Is A Credit Utilization Rate Experian

Credit Utilization How It Works And How To Improve It Lexington Law

How Credit Card Utilization Affects Credit Scores Credit Karma

Comments

Post a Comment